- What we offer

- Who we serve

- Digital Transformation

- Our Approach

- Careers

- About Us

- Contact Us

In the last three years, the commercial real estate industry has seen a huge shift in investor sentiment as a result of the reduction in interest rates to near-zero levels due to the COVID-19 pandemic. At the onset of the pandemic, the consecutive 50 and 100 bps cuts to the interest rate to bring it down to 0-0.25% in March 2020 resulted in a flurry of refinancing activity, with borrowers gaining from the reduced cost of capital. Until Q1 2022, the interest rate levels largely remained flat, and the uptick in lending activity continued. After eight consecutive quarters of low-interest rates, the Federal Reserve started raising rates in Q1 2022, leading to their highest level in 15 years by January 2023.

When the interest rates hit rock bottom, refinancing mortgage loans became the norm of the day with most of our clients reaching out for support in creating refinancing proposals for the agency side of the business including FHA 232(f) loans.

The high inflation rate, coupled with geopolitical factors (the Ukraine war), broke the longest low-interest rate reign. Still, the 25 bps hike in interest rates in Q1 2022 did not dampen lending activity, with warehouses, self-storage facilities, and life science properties gaining the favor of lenders. However, after the consecutive rate hikes from March 2022 to January 2023, lending activity came to a screeching halt.

With continuous rate hikes and inflation at a 40-year high of 9.06%, the uncertainty of rising cap rates and declining property values have prompted both lenders and borrowers to take a wait-and-see approach.

So, to stay ahead of the curve and ensure success in the coming year, what are some key focus areas for CRE players in 2023?

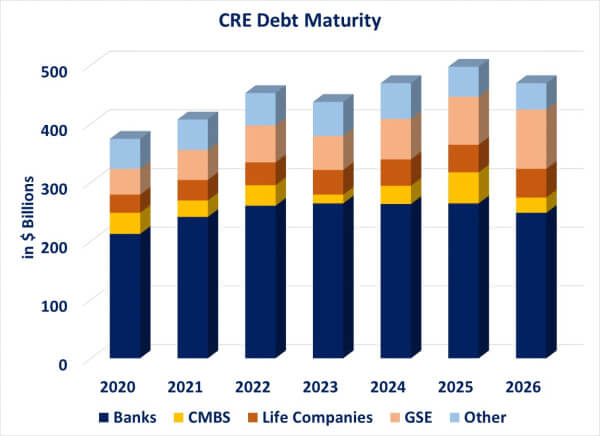

The maturity of a large volume of loans in 2023 and 2024 is a significant concern for the commercial real estate industry. With over $425 billion worth of loans maturing in 2023 and 2024 each, there are concerns about the availability of funding to pay off these loans, which could result in an increase in special serviced loans. Hence, active asset management will be needed to regularly assess the value and performance of the property.

The prevailing uncertainty in the market requires enhanced risk analysis, and more frequent portfolio monitoring. Our partner firms have commenced implementing proactive strategies and reached out with requests to expedite the annual portfolio monitoring. We are gearing up to hire and cross train additional resources to manage the enhanced surveillance and monitoring.

2023 is anticipated to have shrinking loan sizes and increased cap rates. With liquidity not being a major concern, lenders are continuing to focus on providing loans for properties with credit-rated tenants, good amenities, and deals requiring a low LTV. Properties with shrinking values on account of an increase in cap rates will be closely monitored, with more loans moving to the closely monitored properties and special services.

While there is certainly a major dip in financing activity, we have noticed an upward tick in loan sizing and deal screening activity. This scenario has arisen due to tightened lending/investment guidelines, causing lenders and investors to screen more deals before finding the perfect match. For example, the deal sizing to underwriting ratio has moved to ~7 sizing per underwriting from the earlier rate of ~3 sizing per underwriting.

Challenges will continue for Class B and C office properties leased to non-credit-rated tenants. Multifamily properties continue to be a strong investment type, with industrial properties following suit despite an increase in vacancy on account of increased subleasing. Activity on the retail front is anticipated to remain at current levels.

The investment sales and brokerage segments will face challenges placing loans that do not meet the stringent lending terms. Evaluating multiple scenarios will become a market need with a more focused approach to creating loan request support and an impactful offering memorandum.

Going forward, the quantum of loans to be screened will increase, and underwriting parameters will be evaluated more closely. Opportunistic lenders may evaluate short-term recapitalization solutions, with long-term financing possibilities to be explored as the market stabilizes. Mortgage banking experts anticipate that lending will begin to pick up by mid-2023.

At Silverskills, our domain and technology experts help real estate servicers, lenders, originators, investors, and brokers respond with agility to dynamic market changes. We come equipped with scalability to meet short- and long-term client needs. Our team ensures changes to timeframes and legal requirements on account of market conditions are met without a hitch. Interested in exploring how we can help you? Just click on the button below and fill out the form, and one of our industry experts will reach out to you.

Please fill the details below. A representative will contact you shortly after receiving your request.